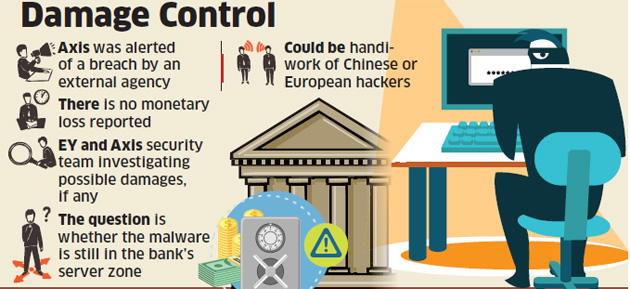

INDIAN BANKING DAMAGE

Why in news? - biggest banking scam in India has come to the forefront, Dewan Housing Finance Corporation Limited(DHFL) has hoodwinked a consortium of banks driven by the Union Bank of India to the tune of ?35,000 crore through financial misrepresentation.

CBI booked Dewan Housing Finance Limited or DHFL and its Directors for allegedly defrauding 17 banks of Rs 34,615 crore. This is the biggest case of bank fraud ever registered by the CBI.

DHFL promoters, including the Wadhawan brothers, are already under investigation by both the CBI and the Enforcement Directorate (ED) in a case of alleged fraud of Yes bank. Such scams can further push NPA.

What is Non-Performing Asset (NPA)? - a classification for loans or advances that are in default or are in arrears on scheduled payments of principal or interest. In most cases, debt is classified as non-performing, when the loan payments have not been made for a minimum period of 90 days.

Reasons behind rising NPAs

- Bad Lending Practices- When banks neglect basic factors like repaying capacity etc.

- Competition- When banks compete amongst themselves and provide unsecured loans

- Overhang Components- When environmental factors act as a cause.

- Incremental Components- When internal bank management like credit policy etc. is affected.

- Crisis- When banking sector witness lower than average rate of revenues and profits.

How does NPA affect?

- Negative impact to economy: Stress in the banking sector causes less money available to fund other projects, therefore, negatively impacting the larger national economy.

- Higher introductory rates: Higher interest rates by the banks to maintain the profit margin.

- Redirecting of funds: Redirecting funds from the good projects to the bad ones.

- Less money dividends to government: In the case of public sector banks, the bad health of banks means a bad return for a shareholder which means that the government of India gets less money as a dividend. Therefore it may impact easy deployment of money for social and infrastructure development and results in social and political cost.

- Balance sheet syndrome: It is of Indian characteristics that both the banks and the corporate sector have stressed balance sheets and cause halting of the investment-led development process.

- Litigations: NPAs related cases add more pressure to already pending cases with the judiciary.

Problems of Banking Sector

- Inside workers and poor lending: Around 34% of scams in the banking industry are on account of inside work and due to poor lending practices by and the involvement of the junior and mid level management.

- Rising bank scams: Fundamental problems in the way of the development of banking in India is on account of rising bank scams and the costs consequently forced on the framework.

- Rise in gross NPAs: In Financial Stability Report released by the RBI, there is a projection of the gross NPAs of banks rising from 6.9% in September 2021 to 8.1% of total assets by September 2022(under a baseline scenario) and to 9.5% under a severe stress scenario.

- Operational failures: All scams, whether interior or outside, are results of operational failures.

- Limited asset monitoring: Limited asset monitoring after disbursement (38%) was the foremost reason behind stressed assets and insufficient due diligence before disbursement (21%) was among the major factors for these NPAs.

- Reduced net interest margin: A high NPA also reduces the net interest margin of banks besides increasing their operating cost, these banks meet this cost by increasing the convenience fee from their small customers on a day to day basis.

- High bad loans of corporate: Corporate loans account for nearly 70% of these bad loans, while retail loans, which include car loans, home loans and personal loans, account for only 4%. Poor bank corporate governance is the cause behind rising bank scams.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)