According to Article 112 of the Indian Constitution, the Union Budget of a year is referred to as the Annual Financial Statement (AFS).

Since the 2020 budget, the Indian economy have reduced from 2.24 lakh crore nominal GDP to Rs 1.94 lakh crore.

This reduction in the size of the economy was due to the lower revenue growth and higher expenditure in the year 2020 because of coronavirus pandemic.

The fiscal deficit for 2021-2022 was estimated to be 6.8% of the GDP.

This was the first ever digital Union Budget.

- Overall, the Budget contains:

- Estimates of revenue and capital receipts,

- Ways and means to raise the revenue,

- Estimates of expenditure,

- Details of the actual receipts and expenditure of the closing financial year and the reasons for any deficit or surplus in that year, and

- The economic and financial policy of the coming year, i.e., taxation proposals, prospects of revenue, spending programme and introduction of new schemes/projects.

- In Parliament, the Budget goes through six stages:

- Presentation of Budget.

- General discussion.

- Scrutiny by Departmental Committees.

- Voting on Demands for Grants.

- Passing an Appropriation Bill.

- Passing of Finance Bill.

The Budget Division of the Department of Economic Affairs in the Ministry of Finance is the nodal body responsible for preparing the Budget.

Key Points

The Budget proposals for 2021-22 rest on 6 pillars.

- Health and Wellbeing

- Physical & Financial Capital, and Infrastructure

- Inclusive Development for Aspirational India

- Reinvigorating Human Capital

- Innovation and R&D

- Minimum Government and Maximum Governance.

- Health and Wellbeing

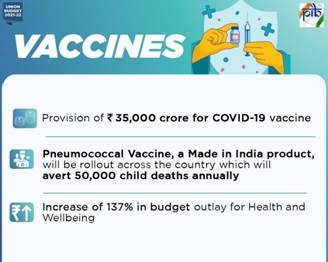

There is substantial increase in investment in Health Infrastructure and the Budget outlay for Health and Wellbeing is Rs 2,23,846 crore in BE 2021-22 as against this year’s BE of Rs 94,452 crore, an increase of 137 percentage.

The Finance Minister announced that a new centrally sponsored scheme, PM AatmaNirbhar Swasth Bharat Yojana, will be launched with an outlay of about Rs 64, 180 crore over 6 years. This will develop capacities of primary, secondary, and tertiary care Health Systems,

Vaccines

Provision of Rs 35,000 crore made for Covid-19 vaccine in BE 2021-22.

The Pneumococcal Vaccine, a Made in India product, presently limited to only 5 states, will be rolled out across the country aimed at averting 50,000 child deaths annually.

Nutrition

To strengthen nutritional content, delivery, outreach, and outcome, Government will merge the Supplementary Nutrition Programme and the PoshanAbhiyan and launch the Mission Poshan 2.0. Government will adopt an intensified strategy to improve nutritional outcomes across 112 Aspirational Districts.

Universal Coverage of Water Supply and Swachch Bharat Mission

The Finance Minister announced that the JalJeevan Mission (Urban), will be launched for universal water supply in all 4,378 Urban Local Bodies with 2.86 crore household tap connections, as well as liquid waste management in 500 AMRUT cities.

- Physical and Financial Capital and Infrastructure

AatmaNirbhar Bharat-Production Linked Incentive Scheme

Finance Minister said that for a USD 5 trillion economy, our manufacturing sector has to grow in double digits on a sustained basis. Our manufacturing companies need to become an integral part of global supply chains, possess core competence and cutting-edge technology.

To achieve all of the above, PLI schemes to create manufacturing global champions for an AatmaNirbhar Bharat have been announced for 13 sectors. For this, the government has committed nearly Rs.1.97 lakh crore in the next 5 years starting FY 2021-22. This initiative will help bring scale and size in key sectors, create and nurture global champions and provide jobs to our youth.

Textiles

Similarly, to enable the textile industry to become globally competitive, attract large investments and boost employment generation, a scheme of Mega Investment Textiles Parks (MITRA) will be launched in addition to the PLI scheme.

This will create world class infrastructure with plug and play facilities to enable create global champions in exports. 7 Textile Parks will be established over 3 years.

Infrastructure

The National Infrastructure Pipeline (NIP) which the Finance Minister announced in December 2019 is the first-of-its-kind, whole-of-government exercise ever undertaken. The NIP was launched with 6835 projects; the project pipeline has now expanded to 7,400 projects. Around 217 projects worth Rs 1.10 lakh crore under some key infrastructure Ministries have been completed.

Infrastructure financing - Development Financial Institution (DFI)

Dwelling on the infrastructure sector, Smt Sitharaman said that infrastructure needs long term debt financing. A professionally managed Development Financial Institution is necessary to act as a provider, enabler and catalyst for infrastructure financing. Accordingly, a Bill to set up a DFI will be introduced. Government has provided a sum of Rs 20,000 crore to capitalise this institution and the ambition is to have a lending portfolio of at least Rs 5 lakh crore for this DFI in three years time.

Asset Monetisation

Monetizing operating public infrastructure assets is a very important financing option for new infrastructure construction. A “National Monetization Pipeline” of potential Brownfield infrastructure assets will be launched. An Asset Monetization dashboard will also be created for tracking the progress and to provide visibility to investors. Some important measures in the direction of monetisation are:

- National Highways Authority of India and PGCIL each have sponsored one InvIT that will attract international and domestic institutional investors. Five operational roads with an estimated enterprise value of Rs 5,000 crore are being transferred to the NHAIInvIT. Similarily, transmission assets of a value of Rs 7,000 crore will be transferred to the PGCIL InvIT.

- Railways will monetize Dedicated Freight Corridor assets for operations and maintenance, after commissioning.

Roads and Highways Infrastructure

Finance Minister announced that more than 13,000 km length of roads, at a cost of Rs 3.3 lakh crore, has already been awarded under the Rs. 5.35 lakh crore Bharatmala Pariyojana project of which 3,800 kms have been constructed. By March 2022, Government would be awarding another 8,500 kms and complete an additional 11,000 kms of national highway corridors.

Railway Infrastructure

Indian Railways have prepared a National Rail Plan for India – 2030. The Plan is to create a ‘future ready’ Railway system by 2030. Bringing down the logistic costs for our industry is at the core of our strategy to enable ‘Make in India’. It is expected that Western Dedicated Freight Corridor (DFC) and Eastern DFC will be commissioned by June 2022.

For Passenger convenience and safety the following measures are proposed:

- Introduction of aesthetically designed Vista Dome LHB coach on tourist routes to give a better travel experience to passengers.

- The safety measures undertaken in the past few years have borne results. To further strengthen this effort, high density network and highly utilized network routes of Indian railways will be provided with an indigenously developed automatic train protection system that eliminates train collision due to human error.

- Budget also provided a record sum of Rs. 1,10,055 crore, for Railways of which Rs. 1,07,100 crore is for capital expenditure.

Urban Infrastructure

Government will work towards raising the share of public transport in urban areas through expansion of metro rail network and augmentation of city bus service. A new scheme will be launched at a cost of Rs. 18,000 crore to support augmentation of public bus transport services.

A total of 702 km of conventional metro is operational and another 1,016 km of metro and RRTS is under construction in 27 cities. Two new technologies i.e., ‘MetroLite’ and ‘MetroNeo’ will be deployed to provide metro rail systems at much lesser cost with same experience, convenience and safety in Tier-2 cities and peripheral areas of Tier-1 cities.

Power Infrastructure

The past 6 years have seen a number of reforms and achievements in the power sector with the addition of 139 Giga Watts of installed capacity, connecting an additional 2.8 crore households and addition of 1.41 lakh circuit km of transmission lines.

Ports, Shipping, Waterways

Major Ports will be moving from managing their operational services on their own to a model where a private partner will manage it for them. For the purpose the budget proposes to offer more than Rs. 2,000 crore by Major Ports on Public Private Partnership mode in FY21-22.

Petroleum & Natural Gas

The following key initiatives are being announced:

- Ujjwala Scheme which has benefited 8 crore households will be extended to cover 1 crore more beneficiaries.

- Government will add 100 more districts in next 3 years to the City Gas Distribution network.

- A gas pipeline project will be taken up in Union Territory of Jammu & Kashmir.

- An independent Gas Transport System Operator will be set up for facilitation and coordination of booking of common carrier capacity in all-natural gas pipelines on a non-discriminatory open access basis.

Financial Capital

The Finance Minister proposed to consolidate the provisions of SEBI Act, 1992, Depositories Act, 1996, Securities Contracts (Regulation) Act, 1956 and Government Securities Act, 2007 into a rationalized single Securities Markets Code. The Government would support the development of a world class Fin-Tech hub at the GIFT-IFSC.

Increasing FDI in Insurance Sector

She also proposed to amend the Insurance Act, 1938 to increase the permissible FDI limit from 49% to 74% and allow foreign ownership and control with safeguards. Under the new structure, the majority of Directors on the Board and key management persons would be resident Indians, with at least 50% of Directors being Independent Directors, and specified percentage of profits being retained as general reserve.

Disinvestment and Strategic Sale

In spite of COVID-19, Government has kept working towards strategic disinvestment. The Finance Minister said a number of transactions namely BPCL, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans, NeelachalIspat Nigam limited among others would be completed in 2021-22. Other than IDBI Bank, Government propose to take up the privatization of two Public Sector Banks and one General Insurance company in the year 2021-22.

In 2021-22, Government would also bring the IPO of LIC for which the requisite amendments will be made in this Session itself.

3. Inclusive Development for Aspirational India

Under the pillar of Inclusive Development for Aspirational India, the Finance Minister announced to cover Agriculture and Allied sectors, farmers’ welfare and rural India, migrant workers and labour, and financial inclusion.

Agriculture

Dwelling on agriculture, she said that the Government is committed to the welfare of farmers. The MSP regime has undergone a sea change to assure price that is at least 1.5 times the cost of production across all commodities. The procurement has also continued to increase at a steady pace. This has resulted in increase in payment to farmers substantially.

Migrant Workers and Labourers

Government has launched the One Nation One Ration Card scheme through which beneficiaries can claim their rations anywhere in the country. One Nation One Ration Card plan is under implementation by 32 states and UTs, reaching about 69 crore beneficiaries – that’s a total of 86% beneficiaries covered. The remaining 4 states and UTs will be integrated in the next few months.

Financial Inclusion

To further facilitate credit flow under the scheme of Stand Up India for SCs, STs, and women, the Finance Minister proposed to reduce the margin money requirement from 25% to 15%, and to also include loans for activities allied to agriculture. Moreover, a number of steps were taken to support the MSME sector and in this Budget, Government has provided Rs. 15,700 crore to this sector – more than double of this year’s BE.

4. Reinvigorating Human Capital

The Finance Minister said that the National Education Policy (NEP) announced recently has had good reception, while adding that more than 15,000 schools will be qualitatively strengthened to include all components of the National Education Policy. She also announced that 100 new Sainik Schools will be set up in partnership with NGOs/private schools/states.

She also proposed to set up a Higher Education Commission of India, as an umbrella body having 4 separate vehicles for standard-setting, accreditation, regulation, and funding. For accessible higher education in Ladakh, Government proposed to set up a Central University in Leh.

Scheduled Castes and Scheduled Tribes Welfare

Government has set a target of establishing 750 Eklavya model residential schools in tribal areas with increase in unit cost of each such school from Rs. 20 crore to Rs. 38 crore, and for hilly and difficult areas, to Rs. 48 crore. Similarly, under the revamped Post Matric Scholarship Scheme for the welfare of Scheduled Castes, the Central Assistance was enhanced and allocated Rs. 35,219 crore for 6 years till 2025-2026, to benefit 4 crore SC students.

Skilling

An initiative is underway, in partnership with the United Arab Emirates (UAE), to benchmark skill qualifications, assessment, and certification, accompanied by the deployment of certified workforce. The Government also has a collaborative Training Inter Training Programme (TITP) between India and Japan to facilitate transfer of Japanese industrial and vocational skills, technique, and knowledge and the same would be taken forward with many more countries.

5. Innovation and R&D

The Finance Minister said that in her Budget Speech of July 2019, She had announced the National Research Foundation and added that the NRF outlay will be of Rs. 50,000 crore, over 5 years. It will ensure that the overall research ecosystem of the country is strengthened with focus on identified national-priority thrust areas.

Government will undertake a new initiative – National Language Translation Mission (NTLM). This will enable the wealth of governance-and-policy related knowledge on the Internet being made available in major Indian languages.

The New Space India Limited (NSIL), a PSU under the Department of Space will execute the PSLV-CS51 launch, carrying the Amazonia Satellite from Brazil, along with a few smaller Indian satellites.

As part of the Gaganyaan mission activities, four Indian astronauts are being trained on Generic Space Flight aspects, in Russia. The first unmanned launch is slated for December 2021.

6. Minimum Government, Maximum Governance

Dwelling on the last of the six pillars of the Budget, the Finance Minister proposed to take a number of steps to bring reforms in Tribunals in the last few years for speedy delivery of justice and proposes to take further measures to rationalised the functioning of Tribunals.

Government has introduced the National Commission for Allied Healthcare Professionals Bill in Parliament, with a view to ensure transparent and efficient regulation of the 56 allied healthcare professions. She also announced that the forthcoming Census could be the first digital census in the history of India and for this monumental and milestone-marking task, Rs. 3,768 crore allocated in the year 2021-2022.

In accordance with the views of the 15th Finance Commission, Government is allowing a normal ceiling of net borrowing for the states at 4% of GSDP for the year 2021-2022.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)